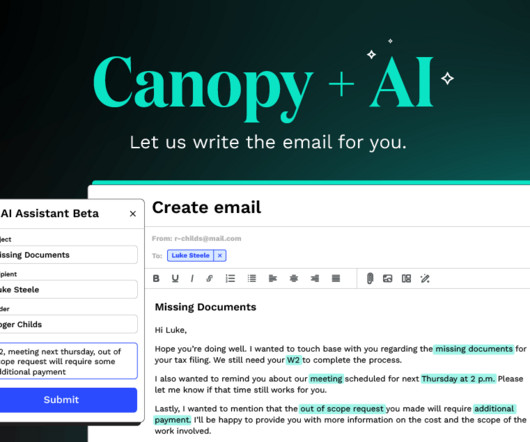

Canopy Launches ChatGPT AI in Accounting Practice Management Software | Canopy

Canopy Accounting

APRIL 21, 2023

If you've spent any time near a screen lately, you’ve heard of ChatGPT — a language model trained by OpenAI. Every day, a new thread appears of someone who has figured out the next thing ChatGPT can do. With the evolution of AI and OpenAI-based architecture, almost every industry must decide how to incorporate AI into their work models, including ours.

Let's personalize your content